Why Revenue Recognition Matters for SaaS Businesses

Let's be honest—accurate revenue recognition is crucial for SaaS businesses. It ensures financial transparency, compliance with accounting standards, and better strategic decision-making.

Without proper revenue tracking, businesses risk cash flow issues, inaccurate financial reporting, and compliance risks—all of which can slow growth.

This guide explores key SaaS revenue metrics, their impact on financial health, and how to manage them effectively.

👉 (Learn how Spectabill is empowering SaaS businesses in Africa)

1. Understanding Deferred & Unbilled Revenue

One of the biggest challenges in SaaS accounting is recognizing revenue at the right time. Two critical concepts help:

Deferred Revenue (Liability)

Deferred revenue, or unearned revenue, is money invoiced but not yet recognized because the service hasn’t been fully delivered. Since the company is obligated to provide the service, it’s classified as a liability.

Unbilled Revenue (Asset)

Unbilled revenue represents recognized revenue that hasn’t been invoiced yet, often due to contract milestones or billing schedules. Unlike deferred revenue, it is an asset (a receivable) until it is invoiced.

A founder in Nairobi recently told us: "We looked like we were thriving with high cash balances, but our deferred revenue liability was growing faster than our ability to service it." Scary stuff.

2. Monthly Recurring Revenue (MRR) & Annual Recurring Revenue (ARR)

SaaS businesses rely on predictable revenue streams. That’s where MRR and ARR come in.

Monthly Recurring Revenue (MRR)

MRR is the core indicator of SaaS financial health, reflecting revenue from subscriptions:

- New MRR → Revenue from new customers.

- Expansion MRR → Additional revenue from upgrades and add-ons.

- Contraction MRR → Revenue lost from downgrades and churn.

MRR = Number of customers × Average monthly revenue per customer

For example: If you have 100 customers paying an average of KSh 5,000 per month, your MRR is KSh 500,000.

The ProfitWell B2B SaaS Index increased at a compound annual growth rate (CAGR) of 8.4% in September, with MRR growth hitting 22.6% in April 2024 - the highest monthly growth since February 2023.

Annual Recurring Revenue (ARR)

ARR is simply MRR annualized, offering a long-term revenue projection that’s crucial for investors and financial planning.

ARR = MRR × 12

For example: If your MRR is KSh 500,000, your ARR would be KSh 6,000,000.

Tracking MRR and ARR helps businesses make data-driven decisions on growth strategies, pricing models, and retention efforts.

3. Bookings, Billings & Recognized Revenue

To avoid financial mismanagement, SaaS businesses must understand three key terms:

Bookings: Future Revenue Commitments

Bookings represent contracted revenue that a customer has agreed to pay over time. Key types include:

- New Bookings → First-time customer contracts.

- Expansion Bookings → Upsells or add-ons from existing customers.

- Renewal Bookings → Revenue from contract renewals.

Billings: Invoiced Revenue

Billings refer to the amount invoiced to customers. A gap between high bookings and low billings could indicate cash flow issues.

Recognized Revenue: The Most Accurate Metric

Unlike bookings and billings, revenue is only recognized when the service is delivered—ensuring compliance with GAAP (Generally Accepted Accounting Principles).

Over-reliance on bookings or billings can distort financial health. Recognized revenue provides the most accurate picture of business performance.

4. Churn Rate & Customer Retention Metrics

SaaS success isn’t just about acquiring customers but keeping them.

Churn Rate: The Revenue Killer

Churn measures the percentage of customers who cancel subscriptions:

Voluntary Churn → Customers actively cancel.

Involuntary Churn → Payment failures (e.g., expired cards).

Monthly Churn Rate = (Number of customers lost in a month) ÷ (Total customers at the beginning of the month) × 100%

Take Netflix as inspiration - their churn rate in the third quarter of 2024 was just 2.17%, with 300 million active worldwide subscribers. They maintain this low rate through their strong content library, personalized recommendation engine, and continuous investment in original programming.

Customer Retention Rate: A Growth Indicator

A high retention rate signals strong product-market fit and customer satisfaction.

Even a small improvement in retention can significantly boost long-term revenue.

Retention Rate = (1 - Churn Rate) × 100%

For example: If your churn rate is 5%, your retention rate is 95%.

5. Customer Acquisition Cost (CAC) & Lifetime Value (LTV)

Customer Acquisition Cost (CAC)

CAC includes all marketing and sales expenses needed to acquire a new customer. A high CAC can drain profitability if not managed well.

CAC = (Sales and marketing expenses) ÷ (Number of new customers acquired)

According to local data from Kenyan tech hubs, B2C SaaS companies spend around KSh 15,000 per customer while enterprise SaaS companies serving major Kenyan corporations shell out upwards of KSh 500,000!

Customer Lifetime Value (LTV)

LTV represents the total revenue a customer generates before churning.

A healthy SaaS business maintains an LTV-to-CAC ratio of 3:1 or higher—meaning a customer should generate at least 3x the cost of acquisition.

LTV = (Average monthly revenue per customer) ÷ (Monthly churn rate)

For example, if your customers pay KSh 5,000 monthly with a 5% churn rate, each one is worth approximately KSh 100,000 over their lifetime. Understanding customer value helps in making informed business decisions and optimizing revenue strategies.

How Spectabill Transforms Revenue Recognition

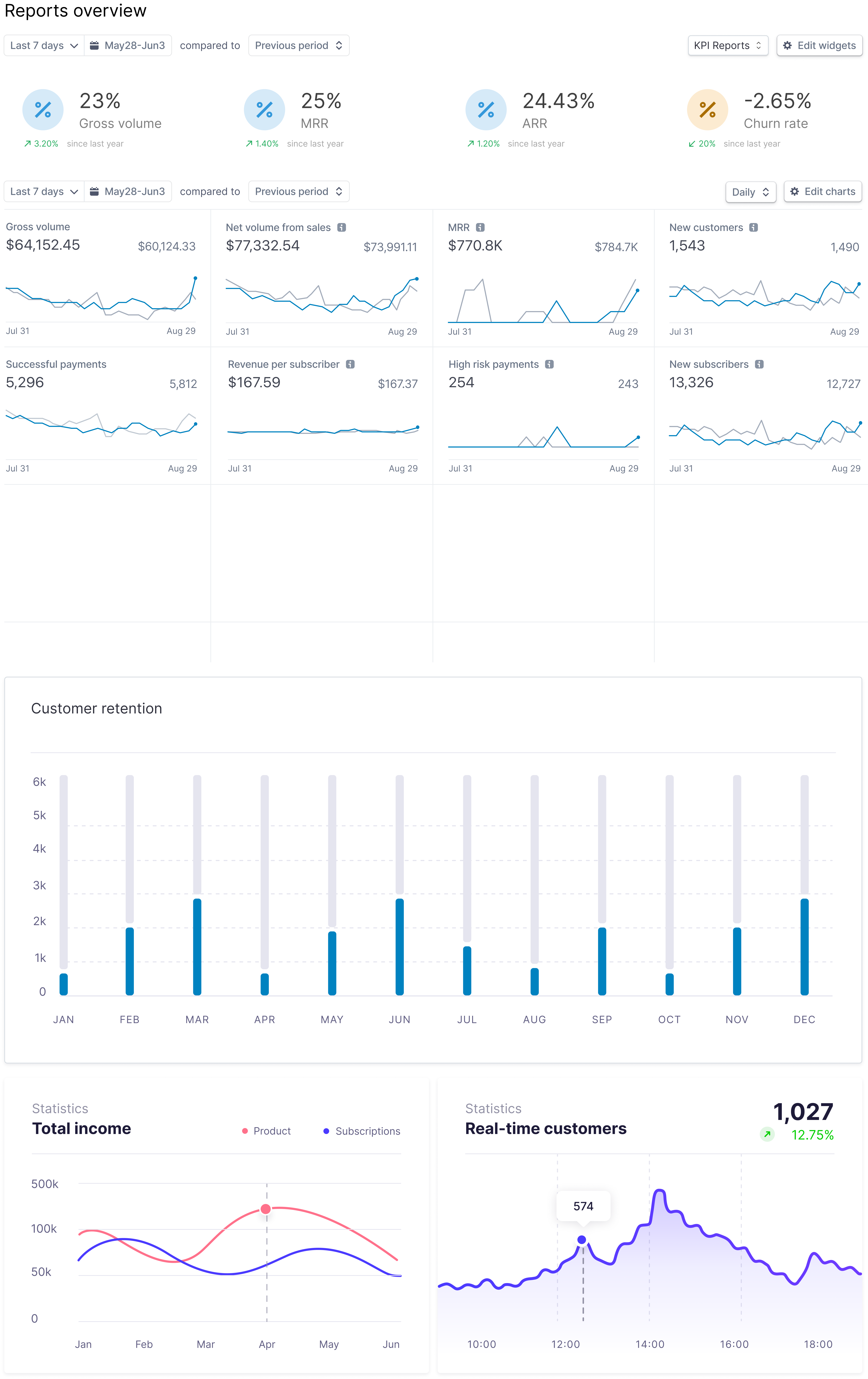

Revenue recognition shouldn’t be a challenge. Spectabill simplifies tracking bookings, billings, and recognized revenue, allowing SaaS businesses to focus on growth.

With Spectabill, you can:

✔ Customize revenue recognition rules to fit any pricing model—from usage-based to tiered subscriptions.

✔ Integrate seamlessly with your tech stack using our robust APIs and comprehensive documentation.

✔ Monitor revenue metrics in real time with interactive dashboards and automated alerts.

✔ Automate billing workflows across multiple payment gateways and currencies.

Transform Your Revenue Operations Today

Modern SaaS businesses need more than just a billing tool—they need a scalable revenue platform. Spectabill offers:

- Flexible pricing management to handle complex revenue models.

- Seamless integrations with existing tools for smooth operations.

- Real-time analytics to provide actionable revenue insights.

- Automated billing for efficient financial workflows.

Whether you're expanding into new markets, optimizing revenue streams, or managing intricate pricing structures, Spectabill equips you with the tools to succeed.

👉 Book a demo to see Spectabill in action.

👉 Get Started and experience the difference yourself.